Using Bitcoin for Illicit Purposes Is Harder Than Using U.S. Dollar

The numbers speak for themselves.

Smear campaigns by politicians, central bankers and economists have succeeded in creating a true urban legend around Bitcoin. Listening to these fierce opponents of Bitcoin, Bitcoin is said to promote money laundering and is used more than the U.S. Dollar for illicit purposes.

The problem with this type of urban legend is that the general public ends up believing it, and no one tries to study the numbers to challenge the legend.

However, a study of the actual numbers shows that Bitcoin is used less than the U.S. Dollar for illicit purposes. In this story, I will demonstrate this.

I will go even further and explain why it is actually more difficult to use Bitcoin for illegal purposes than the U.S. Dollar and the current system.

One Percent of All Bitcoin Transactions Are Related to Illicit Activities

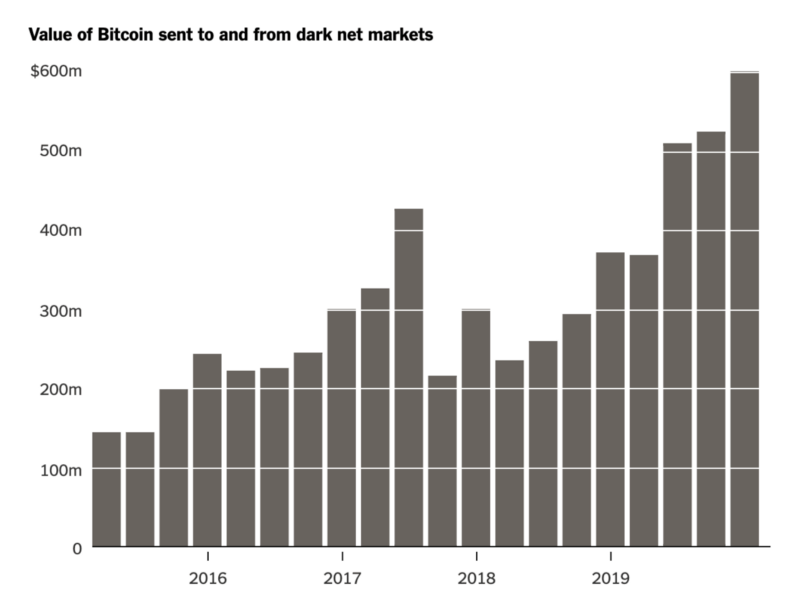

Chainalysis has just published the 2020 edition of its Crypto Crime Report. This annual report provides a comprehensive analysis of the use of Bitcoin and cryptocurrencies for illicit activities.

The Chainalysis report shows that during the last quarter of 2019, the equivalent of $601 million in Bitcoin was sent to the darknet markets.

This figure represents a considerable increase of around 100% compared to the same quarter of the previous year.

A simplistic analysis of such a figure could lead to the conclusion that Bitcoin promotes illegal activities.

This is what opponents of Bitcoin usually do in order to convince the general public of the harmful side of Bitcoin.

As is often the case with numbers, it is necessary to go further than a quick read to get to the bottom of the problem.

Of course, there is no denying that it is of concern that $601 million in Bitcoin was used for illicit activities in the last quarter of 2019.

Nevertheless, it seems important to put this figure into perspective with the overall volume of transactions on the Bitcoin Blockchain in 2019.

Bitcoin did $673 billion in adjusted on-chain transaction volume in 2019.

In reality, Bitcoin transactions to accounts known to be involved in illegal activities represent only 1% of the total volume of Bitcoin transactions.

It’s too much, but it’s not that much when you put these numbers into perspective like I’m going to do.

Two Percent of Global Money Supply Is Used For Money Laundering

It makes no sense to talk about the percentage of Bitcoin transactions used for illicit activities if we do not compare this figure to what exists in the current monetary and financial system.

According to the United Nations Office on Drugs and Crime, suspicious transactions in the current system amount to at least $2 trillion a year.

This figure seems to have been declining for a few years but it is still huge.

The efforts undertaken by the various countries to strengthen controls since the banking and financial crisis of 2008 have led to an improvement.

Nevertheless, the multi-billion dollar fines imposed have not really cooled the ardor of money launderers.

They were simply slowed down for a few months before they started up again as before.

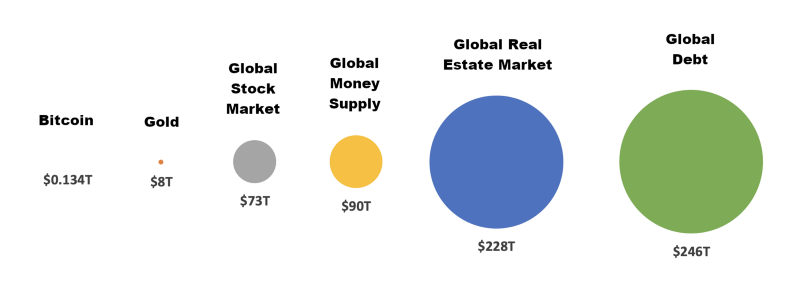

In 2019, the global money supply in circulation was estimated to be in the order of $90 trillion.

This figure should be compared to what the capitalization of Bitcoin or the global debt was at the end of 2019:

Since it is difficult to estimate precisely the global money supply in circulation since it is constantly increasing, it is considered that it could be around $100T in 2020.

Roughly speaking, it can therefore be considered that at least 2% of the global money supply is used for money laundering every year.

The figure is probably even higher, but 2% is already a very high figure.

The worst thing is that this estimate only takes into account money laundering without taking into account other illicit activities such as the sale of arms or drugs for example.

The percentage of the global money supply in circulation used for illicit purposes must therefore be much higher than 2%.

Bitcoin Is Far Less Used Than U.S. Dollar for Illicit Purposes

Comparing the figures for the use of Bitcoin and the U.S. Dollar for illicit activities, it can therefore be seen that Bitcoin is used proportionally less than the U.S. Dollar for illicit purposes.

I think it is even more interesting to put the amount of Bitcoin used for illicit activities into perspective with the amount used in U.S. Dollar for money laundering.

In the last quarter of 2019, the Chainalysis report states that $601 million Bitcoins were sent to the darknet markets.

Extrapolating this figure for the whole of 2020, it can be estimated that it will be in the order of $2.5 billion.

The United Nations estimates that at least $2 trillion is used each year in the current financial system to launder money.

In other words, every time $1 is used to launder money, only $0.00125 in Bitcoin is used for illegal activities.

Bitcoin is therefore used far less than the U.S. Dollar for illicit purposes.

Humans, such as opponents of Bitcoin, may lie, but numbers don’t lie.

Bitcoin does not ask you to take the word of humans, but rather to believe the laws of mathematics that do not lie.

A Big Difference Between the Use of Bitcoin and the U.S. Dollar for Illicit Purposes

We have just seen that Bitcoin is used less than the U.S. Dollar for illicit purposes. That’s something politicians or bankers will never tell you.

There is also another fundamental difference to be aware of between the use of Bitcoin and the use of the U.S. Dollar for illicit activities.

The use of Bitcoin for illegal activities is not supported by any official entity since Bitcoin has no leader.

On the other hand, money laundering within the banking world is often supported by traditional bankers.

These bankers do not hesitate to help drug cartels or sanctioned governments move money around the world.

The case of Danske Bank, whose Estonian subsidiary laundered 200 billion euros, is indicative of what has been happening in the banking world for decades.

The current monetary and financial system is therefore very often complicit in money laundering and illicit activities that take place with the U.S. Dollar.

This type of illicit activity is therefore more difficult to stop, since the people at the head of this system are accomplices.

Bitcoin Is Transparent and Makes It Harder to Use for Illegal Purposes

Bitcoin is used for illicit purposes. This is an undeniable fact and further proof, if needed, that Bitcoin were to become a real currency.

Real currency is used for legal as well as illegal purposes.

It’s an unfortunate thing, but that’s the way life is.

On the other hand, the study of the figures clearly shows that Bitcoin is used less than the U.S. Dollar for illicit purposes.

The reason for this is basically simple.

Bitcoin is completely transparent and every transaction made in Bitcoin is recorded forever on its Blockchain.

This makes it easier for the authorities in each country to track down people using Bitcoin for illicit purposes than with the traditional banking system, where some people try by every means to conceal fraudulent transactions.

In fact, many criminals using Bitcoin for their activities have already been found and arrested.

Bitcoin is being used more and more and the volume of transactions on its Blockchain will continue to grow in the coming years.

In fact, the amount of Bitcoin transactions to the darknet markets will probably continue to increase in the future.

Nevertheless, proportionally, this will still remain tiny compared to what happens in U.S. Dollar with the current monetary and financial system.

In the future, when politicians or bankers criticize Bitcoin with arguments that you find dubious, feel free to take a critical look at the figures.

In this regard, it is important to remember what Bitcoin is promoting:

Don’t trust governments and humans, but trust Mathematics because Mathematics don’t lie.

2 Responses

[…] This argument is totally false, as I have already explained in a story in the past. Bitcoin is used even less than the U.S. Dollar for illicit purposes. […]

[…] In particular, I invite you to read the story in which I explain that Bitcoin is actually more difficult to use than the U.S. dollar for illicit purposes. […]