The Two Biggest Reasons Why Bitcoin Price Will Reach $1,000,000 Within 20 Years

The success of Bitcoin in the future is inevitable.

Bitcoin is already a huge success. In just over eleven years of existence, Bitcoin has managed to attract something like 40 or 50 million users and achieve a market capitalization of $170 billion.

This is all the more impressive given that Bitcoin has only had the support of its community during its first decade of existence.

Bitcoin has not received the support of any government or private investment bank. Bitcoin’s success is in the hands of its users. By offering Bitcoin to its users as a great gift, Satoshi Nakamoto has given them responsibility for the future of Bitcoin.

So far, its users have risen to the challenge brilliantly.

The people who support Bitcoin are like missionaries acting with a passion to help build a better world for all in the future.

Of course, the financial appeal is what brings a majority of new users to the world of Bitcoin. I won’t deny that. However, those who stay in the long run, and end up becoming Bitcoin HODLers, can only do so because they have total confidence in the Bitcoin revolution.

For anyone interested in the world of Bitcoin today, a big question that comes up frequently is:

How much one Bitcoin will be worth in U.S. dollar in the future? Can Bitcoin reach $100,000? $300,000? How about $1 million in the future?

To this question, I’m going to give you my vision. The third Bitcoin Halving took place on May 11, 2020, and we are currently in a period of stagnation before the start of a strong bull market for Bitcoin.

The supply of new Bitcoins is inexorably shrinking

This post-Halving bull market will probably last 18 months. The peak of this bull market is expected to be reached at the end of 2021. At that time, I can very well imagine the Bitcoin price to be very close to $100,000.

This already very impressive figure will only be a start in my opinion. If there is a probable correction afterward, as was the case with the previous Halvings, we should not forget that new Halvings will follow.

Bitcoin’s monetary policy is automated, which means that it cannot be changed by a simple human decision.

Thus, the fourth Bitcoin Halving will take place no matter what happens at block height 840,000. The fifth will take place at block height 1,050,000. And so on.

Given the average issuance time between two blocks of transactions of about 10 minutes, we can estimate that the next Halvings will take place in 2024 and 2028.

While the reward in Bitcoin is only 6.25 BTC in 2020, it will fall to 3.125 BTC in 2024 and then to 1.5625 BTC in 2028. Inflation in the supply of new Bitcoin will continue to decrease in the coming years. It fell to 1.8% after Bitcoin’s third Halving. It will then be below 1% in 2024.

Based on an average of 144 blocks issued each day on the Bitcoin Blockchain, there will only be 450 new Bitcoins produced each day from 2024 onwards. In 2028, this figure will fall to 225 new Bitcoin issued a day.

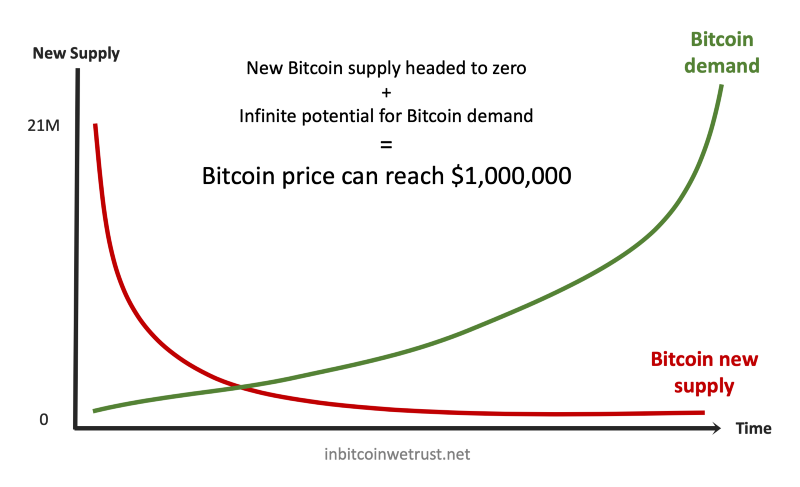

The irremediable fall towards zero of the daily supply of new Bitcoins will be confronted with the second parameter of the law of supply and demand which governs the Bitcoin price:

This second parameter is of course the demand for Bitcoin.

Buying Bitcoin becomes mandatory to hedge against the great monetary inflation

Currently, the number of Bitcoin users represents only 0.4% of the world population. This is very little, but it is normal since Bitcoin is still at an early stage.

The economic crisis of 2020 has highlighted more than ever the flaws of the current monetary and financial system.

The trillions of dollars printed out of thin air by the Fed and other central banks, as well as the trillions of dollars borrowed by all governments to finance stimulus packages, have made a growing number of people feel that fiat money no longer has any value.

The great monetary inflation induced by these easy-money monetary policies is making the rich even richer, while the poor are more than ever in trouble. Income inequality between the richest 1% and the poorest 50% has never been so high.

To hedge against the effects of this inflation, you don’t have much choice if you are not among the richest 1%.

Gold is inaccessible, as is the real estate market. The stock market is manipulated by the Fed’s actions which makes it unattractive if you want to take care of your money future.

The solution that more and more people will adopt is Bitcoin.

The greatest value of Bitcoin today is that it offers its users a great weapon to preserve their wealth. This weapon is all the more powerful because it is resistant to censorship.

In a world where hyperinflation will become an increasingly pervasive problem even within Western countries, Bitcoin will see its demand increase. It is inevitable. The growing number of institutional investors coming to buy Bitcoin is the first signal of this.

The anti-Bitcoin bubble is about to burst.

The potential for growth in demand for Bitcoin is exponential

As soon as this bubble burst, the adoption of Bitcoin will accelerate even faster. This will happen over the next 20 years.

To give you an idea of what this could mean, in 1998, only 0.4% of the world’s inhabitants had the Internet. By 2020, that figure is over 60%. In just 20 years, the number of Internet users has exploded.

The reason is simple: the Internet makes people’s lives better. Some people may have explained that the Internet was too complicated, but in the end, users embraced the Internet because it made their lives better.

With Bitcoin, it will be the same, because Bitcoin makes life better for its users.

Such an explosion in demand for Bitcoin over the next 20 years, coupled with the inevitable drop in inflation in the supply of new Bitcoins, will provide the impetus for the Bitcoin price to reach the million-dollar mark.

The devaluation of the U.S. dollar will play an important role as well

In addition to this first major reason why the Bitcoin price will reach $1 million in the future is a reason that many seem to overlook.

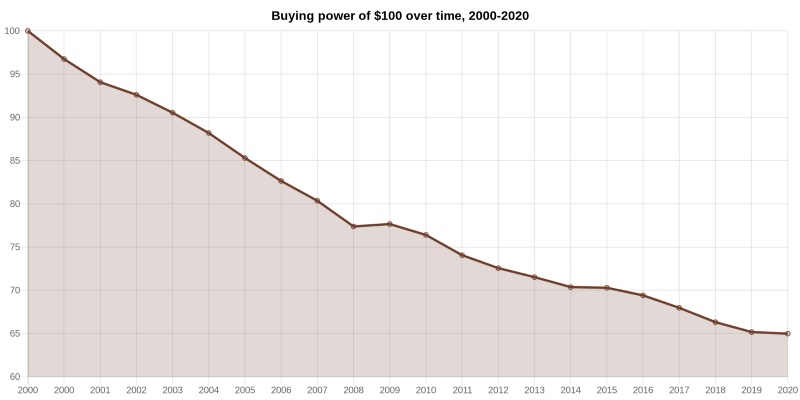

Since 2000, the value of the U.S. dollar, which is the world’s reserve currency, has been falling steadily. A buying power of $100 in 2000 is only $65 in 2020, a 35% drop in only 20 years:

Since the beginning of the current economic crisis, the Fed has just printed more than $3 trillion out of thin air. The M2 Money Stock now exceeds $18,400 billion. At the current rate, the Fed is expected to increase it to $20 trillion by the end of 2020.

Such a large printing of the U.S. dollar in such a short period of time will accentuate the devaluation of the U.S. dollar.

A $100,000 Bitcoin at the end of 2021 will probably be the equivalent of a $1 million Bitcoin in 20 years.

Thus, the coming sharp currency devaluation of the U.S. dollar, and all other fiat currencies, will strengthen the assumption of a $1 million Bitcoin.

Conclusion

Based on this, you don’t have much to do to become rich in 20 years.

Your best chance is probably to accumulate as many Bitcoins as you can in the coming months and years and then become a Bitcoin HODLer to keep your Bitcoins no matter what.

That way, you will have become a millionaire in U.S. dollar thanks to Bitcoin. As far as the Bitcoin world is concerned, you will become one very quickly by following this strategy.

Indeed, owning at least 0.01 BTC is the same as owning 1 million Satoshis. In the world of the future, the basic unit for Bitcoin will probably be Satoshi.

At that time, owning 0.01 BTC will make you a millionaire. As you can see, time will play in your favor if you choose to opt for Bitcoin.