The Federal Reserve Printing Always More Money Is the Best Marketing Campaign for Bitcoin

The same ineffective decisions are repeated over and over again.

It is March 5, 2020, and the coronavirus crisis is gaining momentum around the world. Started in China in early December 2019, the coronavirus is spreading around the world, and we will soon be able to talk about a global pandemic.

This coronavirus has already started to have a strong impact on the Chinese economy, which has been slowing down since the beginning of 2020. As the economies are interlocked at the global level, the United States will soon be impacted as well.

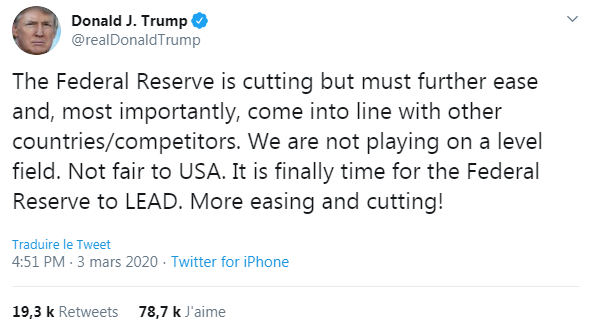

In anticipation of a possible slowdown in the U.S. economy, which would be disastrous in the midst of the U.S. presidential election year, Donald Trump has publicly called on the Federal Reserve to lower interest rates.

In doing so, Donald Trump was simply reiterating a demand he has been making consistently for months. On March 3, 2020, the Federal Reserve finally decided unanimously to cut interest rates by 50 basis points as a matter of urgency.

This decision was taken as a response to the rising fear around the coronavirus which has already created widespread uncertainty in the financial markets with a sharp decline the previous week.

Whatever happens from now on, I have the impression that the central bankers have only one response: to cut interest rates in order to be able to print more and more money.

By doing so, I have the feeling that the Federal Reserve is running a strong marketing campaign in favor of Bitcoin, without even realizing it, as I will explain in the following.

Central Bankers Continue to Print More and More Money

The Federal Reserve’s decision to cut interest rates by 50 basis points will place the target rates between 1% and 1.25%. This decision follows three successive 25 basis point cuts that had already taken place in 2019 in August, September and October respectively.

Looking at the history of the Federal Reserve’s cuts, a 50 basis point cut is a rare occurrence.

In the last 20 years, the Federal Reserve has only cut interest rates by 50 basis points on only 3 occasions: after 9/11, following the banking and financial crisis of 2008, and now with the risk of coronavirus.

In the eyes of the Federal Reserve, the coronavirus thus represents an equivalent risk for the economy that 9/11, or the financial crisis of 2008.

It’s quite incredible to see how the Federal Reserve reacted to an event that hasn’t really impacted the U.S. economy yet.

It only takes a week of falling financial markets for interest rates to be lowered to counteract the potential effects of the coronavirus.

Central bankers may want to believe that the financial markets will grow endlessly. At least the decisions they make are along those lines.

For months now, there have been many voices calling for the United States to bring its rates in line with those of other world economic powers. This drop in interest rates will allow the Federal Reserve to print more and more money by facilitating a policy of quantitative easing.

Naturally, Donald Trump welcomed this decision via one of his many tweets:

Donald Trump has reason to rejoice.

Indeed, a slowdown in the U.S. economy at the very moment when he will have to fight to be re-elected as President of the United States would have been of the worst effect.

Central bankers around the world are pursuing exactly the same economic policy as the Federal Reserve.

One gets the impression that all the men at the head of the current monetary and financial system have become addicted to printing always more money. The problem is that when you use systematically that weapon, it doesn’t produce the same effects at all as before.

Printing More and More Money Devalues What You Own

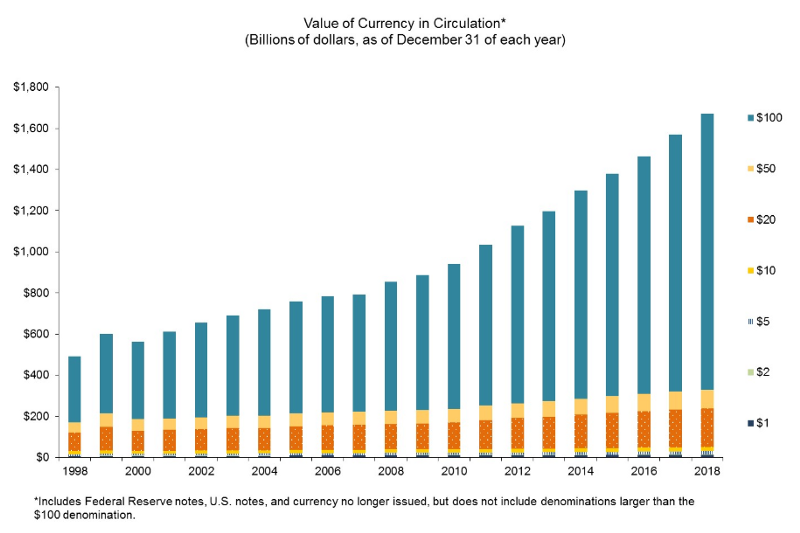

This historic interest rates cut by the Federal Reserve will make it possible to print more money, and thus further increase the U.S. dollar’s money supply in circulation.

The following graph clearly shows that the trend has been accelerating for the last twenty years:

This continual increase in the money supply in circulation artificially inflates financial markets while constantly devaluing what people own.

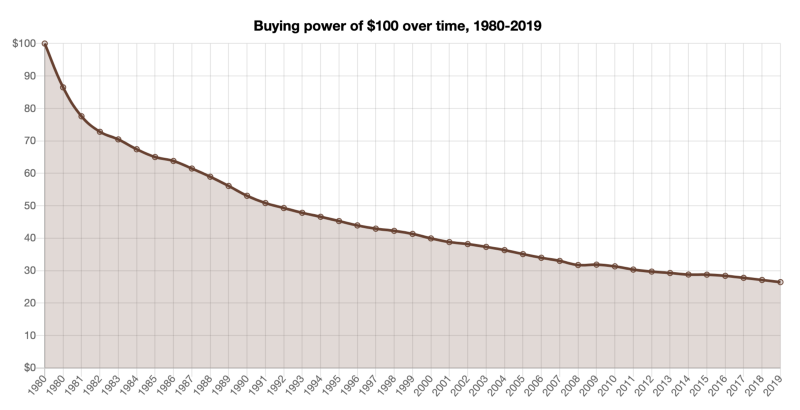

A quick look at the evolution of U.S. purchasing power since 1980 shows how dramatic the problem is:

In other words, the U.S. dollar of 2019 lets you buy less things than the U.S. dollar of 1980.

The real value of the U.S. dollar has declined steadily since 1980.

An American must therefore have $312 in his possession in order for his buying power in 2019 to be equivalent to his buying power of $100 in 1980.

In the past, the weapon of monetary creation has been able to perform services. However, politicians and central bankers have abused it to such an extent that the resulting effects on the economy are now less and less tangible.

Moreover, it produces money that is based on nothing. People feel that money is cheap, and this insidiously pushes them to spend more and more.

The current monetary and financial system has therefore entered an endless vicious circle.

Politicians and central bankers are well aware of this, but they will not change their ways.

It would take courage, and such measures would be unpopular. So they will continue to pursue the same flawed policies in terms of monetary creation year after year.

This Decision of Printing Always More Money Is the Best Marketing Campaign for Bitcoin

The most amazing thing about this decision by the Federal Reserve is that it comes at a time when Bitcoin’s third Halving is less than 65 days away now.

After this third Halving in Bitcoin’s history, the daily creation of new Bitcoins will decrease from 1800 to 900.

The inflation of the Bitcoin supply will thus drop below 2% to 1.8%. Over time, inflation will continue to fall and finally reach 0% when all Bitcoins have been mined by 2140.

In the meantime, the global money supply in circulation will continue to grow as a result of the policies decided by the leaders of the major economic powers.

On the one hand, we will have a U.S. dollar that will continue to lose value, as all the others fiat currencies, and on the other hand, a Bitcoin whose supply will continue to shrink, while demand will necessarily continue to increase.

The behavior of the Federal Reserve, supported by Donald Trump, will therefore highlight at the best of times one of the greatest strengths of Bitcoin: its scarcity.

The total supply of Bitcoin will forever remain limited to 21 million units. Whatever happens in the future, 1 BTC bought 2020 will still be equal to 1 BTC bought in 10, 25 or 100 years.

Sooner or later, even the biggest opponents of Bitcoin will eventually realize that the current system is no longer sustainable. Infinite growth is only a utopia.

Bitcoin will be there to show them that another way is possible: that of a system owned by everyone that pushes you to save rather than spend.

The craziest thing is that it is the owners of the current monetary and financial system who are the first to promote Bitcoin indirectly by showing the failings of their system.

So it is only a matter of time before the superiority of Bitcoin becomes obvious to the majority of people.

2 Responses

[…] The Federal Reserve Printing Always More Money Is the Best Marketing Campaign for Bitcoin […]

[…] The Federal Reserve Printing Always More Money Is the Best Marketing Campaign for Bitcoin […]