The Coronavirus Crisis Could Be Remembered As the Tipping Point for Bitcoin

Future generations will be the ultimate judges.

The coronavirus crisis is the biggest health crisis we have faced since the beginning of the 21st century. The coronavirus has become a true global pandemic highlighting the lack of preparation of the world’s major economic powers for a phenomenon they had not anticipated.

This lack of preparation is having disastrous consequences today. More than 100,000 people around the world have already died from the coronavirus. Worse still, very little is still known about the disease, leaving the world in a state of total uncertainty.

Most of the world’s major powers have chosen the path of containment in order to limit the spread of the virus. This solution, which is necessary to save millions of people, is causing a sharp slowdown in all the world’s major economies.

The Economic Crisis That Has Been Expected for Years Is Here

This sharp slowdown triggered the great economic crisis that had been expected for several years now. The recession will hit most countries in the coming weeks and months.

To combat the devastating effects of the coronavirus on the economy, central banks and governments have taken measures of exceptional magnitude.

For example, the Fed has decided to conduct an unlimited quantitative easing program, while taking care to lower interest rates by 150 basis points during March 2020 in order to conduct an easy money policy that is supposed to provide a monetary stimulus to the U.S. economy.

Little commented, the lowering of the reserve requirement rate to zero for American banks is however something that greatly jeopardizes what you have in U.S. dollar on your bank account. The need to make Bitcoin your own bank is growing every day.

The other central banks are following the same path as the Fed, which is sure to produce a significant currency devaluation in the coming months.

How could it be otherwise?

The numbers are dizzying, but they are real. We’re talking about a liquidity injection of over $8T in the U.S. alone. I don’t even add to that figure the programs that are being conducted by other central banks, otherwise we would be well over $10T already.

The richest people don’t have too much to worry about since it is the poorest 50% who will be impacted first by all these decisions.

They don’t own much, but the little they have will be worth even less in a few weeks.

Coronavirus Crisis Has a Strong Impact on the Economy

This coronavirus crisis is therefore having a strong impact on the economy, and it will profoundly change our way of life in the years to come.

Nevertheless, in the eyes of history, coronavirus may be only one of many events.

There have already been too many deaths from coronavirus, but we are still a long way from the biggest pandemics in the history of the world.

Without wishing to minimize the coronavirus and the damage it has already done, the Spanish flu pandemic that hit the world after the First World War was of a completely different scale.

Apparently landed in Europe via U.S. troops, the Spanish flu contaminated the civilian population of Europe, and then the world in 1919. According to the figures at the time, the pandemic affected between a quarter and a third of the world’s population.

Considered to be the most devastating pandemic in history, the Spanish flu is estimated to have killed between 25 and 50 million people.

Fortunately, the coronavirus is a long way off, and it is to be hoped that the toll will remain much more measured in the coming months compared to the worst pandemics in history.

If the situation improves and the coronavirus pandemic is brought under control in the coming weeks, we could hope to stay well below the half million people killed. That is still far too high a figure, but in the eyes of history it would make the coronavirus a detail of history.

I do not want to shock some people by talking about detail of history, but as an example, seasonal flu kills more than 500,000 people around the world every year.

The coronavirus could therefore be remembered as a detail of history by future generations.

A major detail given the number of human losses, but a detail on the scale of human history. Yet this small piece of history that the coronavirus could become in 20, 50, or 100 years may well be remembered forever as the tipping point for Bitcoin.

Some Events Under the Right Conditions Have Incredible Effects

In life, you’ve probably already noticed that there are times when events that are very similar to others will have incredibly greater consequences. These events are similar to others in the past, but they will occur at a particular time with circumstances that are right for everything to be different afterwards.

When it appeared in December 2019, the coronavirus was at one time compared to SARS (Severe Acute Respiratory Syndrome) which also started in China at the end of 2002. SARS had then caused an epidemic from May 2003 onwards, mainly affecting Asia.

This SARS epidemic still caused a little more than 8,000 deaths at the time.

However, it was apparently better controlled than that of the coronavirus. I’m no expert in medicine, but I guess SARS must have been less contagious than coronavirus, which would explain why its effects were less devastating.

Perhaps the world was also less interconnected than it is today, with less global movement of people. In any case, conditions were fortunately not conducive for SARS to be on a scale comparable to the coronavirus, let alone the Spanish flu.

The Monetary and Financial System Was a Sick Patient Before the Coronavirus

At the time the coronavirus began to spread around the world, the monetary and financial system was far from being in excellent health. Financial markets were still at record highs, but everyone agreed that they had been artificially inflated for several years by the policies of central banks.

The powerful at the helm of the monetary and financial system had clearly not done enough to address the problems that had led to the 2008 crisis.

The system was better on the surface, but its structural flaws were still there.

A simple acceleration in the spread of the coronavirus in early March 2020 was enough to trigger panic in financial markets around the world. Such a virulent reaction of the financial markets made it clear that the fiat system was already ill when this coronavirus crisis began.

The value of companies had been artificially inflated by the central banks, but also by the companies themselves, who had been buying back their own shares for several years, rather than building up a sufficient cash reserve in case of a hard blow.

The economies of the world’s major powers have also continued to accumulate debt since the 2008 crisis to such an extent that the public and private debt of countries reached record highs at the beginning of 2020.

In a sense, all the conditions were practically present for an event such as the coronavirus to have an incredibly strong impact on the economy.

There was no shortage of this, and so the economic crisis that had been hovering over the fiat system for months has now logically begun.

No one knows how far this economic crisis will go, because no one knows when the coronavirus will really be brought under control. The coronavirus is a new disease, and scientific research will necessarily take time in order to be able to produce a vaccine on a large scale to protect as many people as possible.

Flaws in the Monetary and Financial System Are Highlighted Like Never Before

In order to limit the effects of the coronavirus on the economy, the Fed therefore decided to print unlimited amount of U.S. dollar. This is making a lot of noise, and more and more people are beginning to wonder about the consequences of these actions that the Fed is repeatedly taking.

People are wondering all the more as the real effects on the economy of this type of monetary stimulus are less and less important.

What a majority of people who are already poor own is devalued simply to save a system that protects only a minority of the very rich.

Those famous 1%, or even 0.1%, who keep coming to the Fed every time the economy is in trouble to ask for bailouts, even though these ultra rich have taken advantage of the flaws in the system in recent years to get always richer.

The consequences of the greed of these very rich people are somehow non-existent for them, since it is always citizens like you and me who foot the bill.

This bill is represented by the currency devaluation of the U.S. dollar, but also by the increase in the public debt of the United States, which now stands at $24T.

It is not a check for $1,200 that will change the fate of the population unfortunately.

This $1,200 check is actually only intended to put the population to sleep a little longer.

All these events show the flaws of the monetary and financial system at a particular moment in the history where a best alternative to this system has emerged in the last 10 years. That alternative is represented by Bitcoin, which will have its third Halving in less than 30 days from now.

A Special Moment in the Recent History of Bitcoin

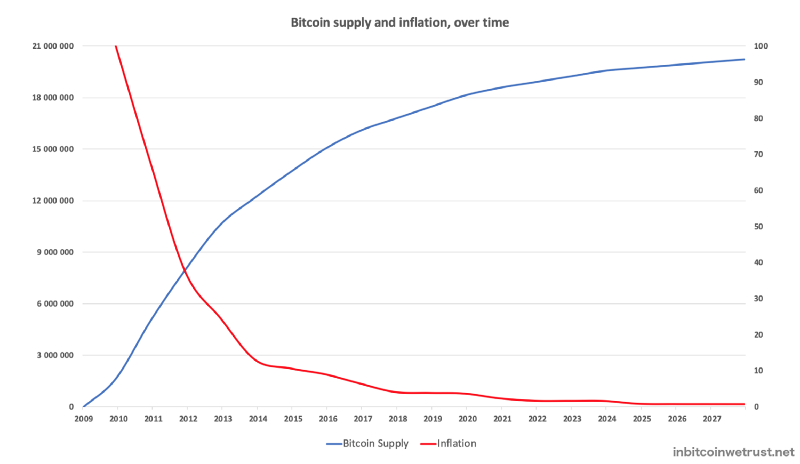

Around 13 May 2020, the daily production of new Bitcoins will be halved. From that date onwards, there will only be 900 new Bitcoins produced each day. A real shock on the supply of Bitcoin will therefore occur.

As a reminder, Bitcoin has a protective monetary policy for its users since the maximum supply in circulation is already known to everyone.

Bitcoin maximum supply is set at 21 million, and this will never change.

Its inflation is constantly decreasing over time, and is now approaching zero. Zero will be reached in 2140 when all Bitcoins have been produced.

By 2021, Bitcoin supply inflation will fall below 2% for the first time in its history to be at 1.8%:

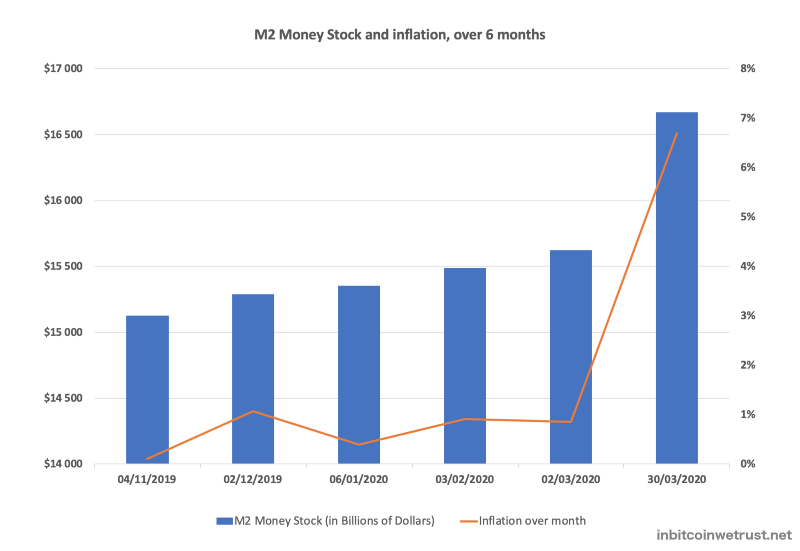

This drop in Bitcoin inflation and especially the evidence of its superior monetary policy comes at the same time as the inflation of the outstanding money supply of the U.S. dollar reached 6.7% in March 2020 alone:

The U.S. dollar money supply could even rise from $16T to $30T by the end of 2020 at this frantic pace.

As an individual, you must understand that such an increase in the money supply will inevitably decrease the value of what you own. Your purchasing power will be eroded even further, as it has already lost nearly 20% since 1971.

This Coronavirus Crisis Could Be the Tipping Point for Bitcoin

Usually, all these manipulations by the Fed and other central banks were ignored, or at least not brought to light by the general public. Since there was no other alternative available, many thought that there was no point in denouncing such practices.

Many resigned themselves to these easy money policies of central banks.

In 2020, the situation is different because Bitcoin exists. It was created by Satoshi Nakamoto after the crisis of 2008 in order to offer to the citizens of the world a solution to deal with the situation we are currently experiencing.

This economic crisis situation we are experiencing is a continuation of the coronavirus crisis. A coronavirus crisis that may well mark the tipping point for Bitcoin.

Bitcoin has grown stronger in its first eleven years of existence as if to be ready for the day when a small detail in human history would have incredible consequences that would change forever the vision of the economy for millions of people.

No one can predict the future, but it seems to me quite possible to imagine that in the future the coronavirus crisis will remain in everyone’s memory as the tipping point for Bitcoin.

That famous tipping point at which Bitcoin will begin its mass adoption. This tipping point after which nothing will ever be the same again.

Only future history will confirm or deny this feeling, but in any case, I can guarantee that the months ahead will be very exciting for Bitcoin.