Master-Slave Dialectic Is the Reason Why Bitcoin Will Win at the End

The freedom that Bitcoin gives you will make the difference.

Bitcoin is a real revolution. It’s a multifaceted revolution that has been gaining momentum block after block for more than eleven years now. Once you really get a sense of what Bitcoin can do for the world, there is no turning back.

It is impossible to turn a blind eye to the failures of today’s monetary and financial system once you have truly begun to see them.

The more you learn about Bitcoin, the stronger your conviction about its win in the world of the future. You finally become a Bitcoiner who fundamentally believes in the success of Bitcoin. Like a missionary ready to accompany the Bitcoin revolution to the end, you become a HODLER of last resort.

However, many people have not yet opened their eyes to the flaws of the current system, and the superiority of Bitcoin.

In the midst of an economic crisis where central banks keep talking about quantitative easing, Bitcoin’s monetary policy is bringing the virtues of quantitative hardening to the forefront.

The battle that is being played out before our eyes right now, and that will last throughout the next decade, is the one that opposes two philosophies:

Bitcoin’s quantitative hardening is head-on opposition to the quantitative easing of the current monetary and financial system.

This confrontation can be likened to the Master-Slave dialectic highlighted by the 19th century German philosopher Hegel.

Better still, by studying more carefully Hegel’s interpretation of this dialectic in “Phenomenology of Spirit”, it becomes clear why Bitcoin will be the dominant force at the end.

Master-Slave dialectic

In “Phenomenology of Spirit”, Hegel portrays a master who does not work, but has his work done by the slave. He lives in the moment, taking advantage of the enjoyment of all that is consumable.

The master knows only the passive side of things. He never takes action.

On the contrary, the slave takes action permanently by working for his master. He transforms things by his will and his work.

By dint of spending his life working hard to transform things, the slave transforms himself. The slave transforms himself at the same time as he transforms the world in which he lives. In fact, the slave gradually appropriates this new world which he helps to build.

In the meantime, the master becomes more and more a stranger to this changing world without taking the real measure of it.

According to Hegel, the slave ends up reversing the relationship of domination to find himself in the fundamental achievement of the human world: equality.

Before this reversal of the relationship of domination occurs, a conflict will necessarily arise.

In this critical moment, the master will be unable to evolve because he will not be able to take the risks necessary for that.

Accustomed to having to adapt, the slave will be able to risk everything to free himself from the master’s domination. Hegel transcribes this imperative very well when he writes this:

“Life is worth what we are capable of risking for it.”

— Hegel

By being able to risk his life, the slave gives his life a real value, which can enable him to free himself from servitude.

The great moral to be retained from this dialectic is that by refusing to evolve, the master becomes dependent on the work of his slave. The master is in a way a slave of his slave.

By working hard, and by giving value to the things of life, the slave attains that famous freedom which is a human ideal.

The current monetary and financial system is an absolute master

Unilaterally and temporarily introduced by Richard Nixon in August 1971, the current monetary and financial system was finally legitimized by the Jamaica Accords in August 1976.

By putting an end to the convertibility of the U.S. dollar into gold, Richard Nixon gave birth to a system that is no longer based on anything tangible.

The best proof of this is given to you now in April 2020. The Fed has just decided to carry out a program of unlimited quantitative easing in a totally arbitrary manner.

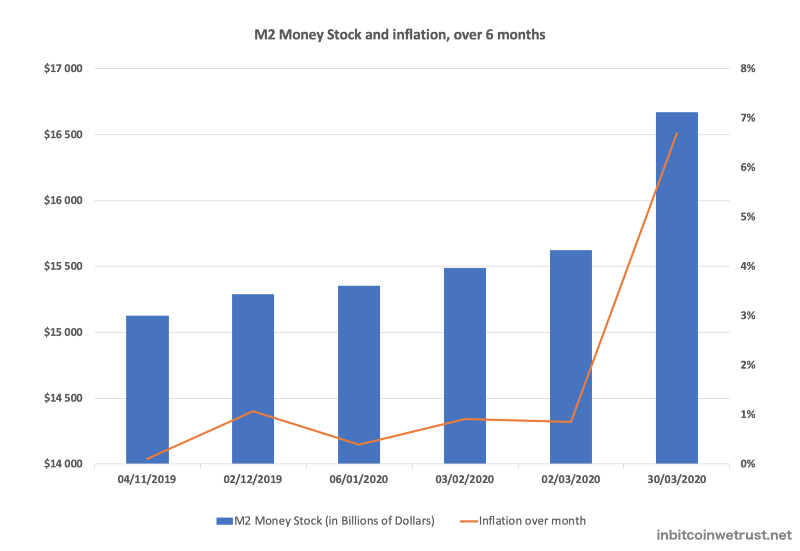

Under the guise of supporting the U.S. economy in the face of the coronavirus crisis, the Fed has already printed more than $8T. In the month of March 2020 alone, the U.S. dollar money supply increased by more than 6%:

At the same time, the United States decided on a $2 trillion stimulus package financed by public debt. This debt has moreover exceeded $24T, i.e. more than 110% of the U.S. GDP.

This type of easy money policy is followed by most of the world’s major economic powers.

The world debt has reached $70T, while the global money supply in circulation will soon be at the level of $100T. All these figures that used to make you dizzy in the past are now becoming the norm.

Talking in trillions of dollars is the new norm in 2020. In 2030, who knows if the new standard will not be trillions of dollars.

Quantitative easing is the easy way out of every economic crisis chosen by the powerful at the head of the monetary and financial system. By doing so, the monetary and financial system is comparable to an absolute master who jeopardizes what his slaves possess.

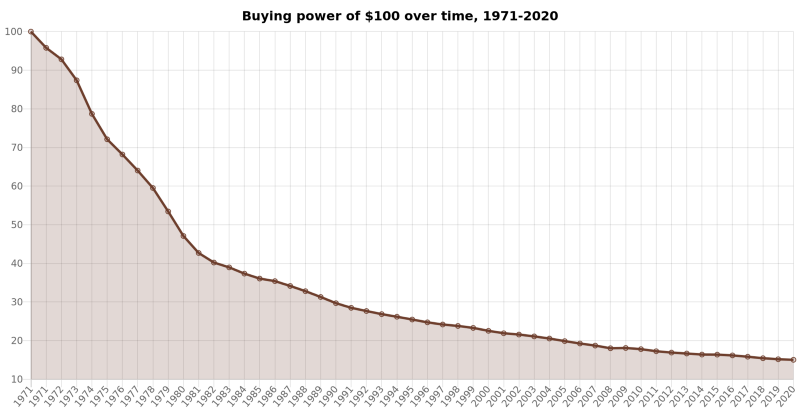

We are all slaves to a fiat system that constantly devalues what we own. If you have any doubts about this, just look at the evolution of a $100 purchasing power since 1971:

A purchasing power of $100 in 1971 is worth only $15 in 2020. If you had kept your $100 throughout that time, you would have lost 85% of the value of your money.

By doing so, the powerful people who run the monetary and financial system are making you work hard for them. They treat you like slaves who have no word to say in their future.

Humans are like slaves trapped in this fiat system

Faced with this indigence of the fiat system, humans finally decided to organize themselves. At the head of these modern-day missionaries is the mysterious Satoshi Nakamoto.

Totally disillusioned by the monetary and financial system following the 2008 crisis, this mysterious character decided to create an alternative called Bitcoin.

Aware of the importance of his invention, Satoshi Nakamoto gave Bitcoin to the world as a gift. Thus, Bitcoin has no leader. It is its users who will decide whether or not to make it a success.

So it is the slaves of the fiat system who will be able to make Bitcoin a success through their unwavering support.

While the powerful at the head of the monetary and financial system take away all value from the fiat money you own and indulge in the easy way out, the slaves are working hard to make the world evolve towards Bitcoin.

The paradigm shift embodied by Bitcoin is underway.

Bitcoin emerges from the people and restores value to essential things

Many opponents of Bitcoin don’t realize this. They are missing the train. The day Bitcoin completes its revolution, the balance of dominance will be completely reversed.

Hegel’s Master-Slave dialectic applies perfectly here to the opposition between the fiat system and humans who are making Bitcoin emerge as a credible alternative.

Bitcoin makes the difference by giving value to essential things of the life. The quantitative hardening that is at the heart of Bitcoin’s monetary policy allows people to completely regain control over what they own.

With Bitcoin, you can save money without risk, because the gradual reduction of the available supply gives more and more value to what you own.

You can therefore consciously choose to keep your Bitcoins rather than being forced to spend them as you do with your fiat currency. As such, HODLING Bitcoin is a great way using Bitcoin.

Supporting Bitcoin all the way through is not an easy thing to do.

This is precisely what makes the work of Bitcoiners so valuable. By supporting Bitcoin, they will gain the freedom to live on their own terms.

A freedom that the current system has deprived people of.

History is on Bitcoin’s side. The current confrontation between the Bitcoiners and the powerful at the head of the fiat system represents the indispensable phase of conflict that Hegel’s Master-Slave dialectic speaks of.

History does not say how long this conflict will last, but it makes it clear that the solution that seeks to restore the value of things by giving people more freedom is the one that will triumph in the end.

Bitcoin embodies that solution. You know what that means for its future.

(Disclaimer: This story contains an affiliate link for the book “Phenomenology of Spirit”. If you choose to make a purchase after clicking this link I may receive a commission at no additional cost to you. Thank you for your support!)