In the Digital World of the Future, Bitcoin Will Remain a Unique Species for Two Main Reasons

Bitcoin is a unique invention in the history of mankind.

The digitalization of the world is a phenomenon that we have been observing for several years now. Nevertheless, this phenomenon is accelerating sharply, and it is now attacking money.

Everything is going digital, and money will not escape this wave of digitalization that is taking over the world.

China understood this very well at the end of 2019 when Xi Jinping made the Blockchain a national priority for his country. While China had an ambiguous strategy until then, Xi Jinping put an end to all prevarication at a session of the Chinese Central Politburo on October 24, 2019.

The Chinese president then called on the country to accelerate the adoption of Blockchain technology as a driver of innovation. Since then, Blockchain has become a national priority for China.

Xi Jinping also called for the development of China’s state-backed digital currency to be strongly accelerated in order to put it into circulation as soon as possible.

China is not far away from officially launching its e-RMB

Since then, China has been working hard on its e-RMB. The progress is notable since the beginning of the year 2020. The state-backed digital currency of China has already been tested in several cities of the country. Foreign partners such as Starbucks and McDonald’s have also positioned themselves to be part of the test phase.

It is always good to be well seen by the Chinese central government when you are a foreign company.

For China, this e-RMB is the missing piece in the puzzle of its social credit system. By imposing the use of this e-RMB, the central government in Beijing will be able to monitor in real time all the transactions carried out by its population.

Better still, and this is obviously another of Beijing’s goals, this e-RMB will enable them to better sanction “bad” citizens.

By gradually eliminating cash, China central government will be able to more easily confiscate what citizens own if they do not respect the rules of the Chinese Communist Party. The Communist Party of China will also be able to block their transactions of everyday life.

With such a weapon, the Chinese population will have no choice but to obey all the wishes of the central power.

China seeks to reduce dependence on U.S. Dollar

This Chinese initiative also aims to fight against the hegemony of the U.S. dollar at the global level. With its U.S. dollar, the United States has an incredible privilege that many describe as exorbitant.

In its quest to become the world’s leading power in the coming years, China cannot afford to be so dependent on the U.S. dollar. This gives too great an advantage to the United States.

China is therefore buying gold in large quantities to reduce its dependence on the U.S. dollar, but this will not be enough.

With its e-RMB, China hopes to be able to impose this digital currency on its partners within the framework of its Belt and Road Initiative project. By trading only with the e-RMB along this road, China would be able to undermine the hegemony of the U.S. dollar.

In its project, China has found a strong ally in Russia, which can no longer tolerate its dependence on the U.S. dollar either. Russia buys a lot of gold as well, and seeks to stop depending on the U.S. dollar.

The share of the U.S. dollar in the trade between China and Russia has been drastically reduced for several years, and the e-RMB could help to eliminate the U.S. dollar from their trade altogether.

China and Russia seem to be moving closer to a third country in their anti-American alliance.

China and Russia have found a third ally against the almighty U.S. dollar

This country is none other than Iran, which has been banished by Donald Trump’s United States in recent years with the aim of toppling the current government. This strategy is not working, and has the effect of diverting Iran from the European Union for example.

Iran has clearly understood that the European Union is not in a position to resist the American will. It is therefore looking for more powerful allies.

The strategic agreement about to be signed between China and Iran is a step in this direction. Planned over 25 years, this agreement would commit Beijing to invest 400 billion dollars in Iran in a variety of areas such as infrastructure, telecommunications and transport.

China would be in a position to deploy its military personnel permanently on Iranian territory to supervise the projects the country finances. Beijing would also have a right of pre-emption on all opportunities linked to Iranian oil projects.

This agreement would allow Iran to protect itself from a possible American military attack on its territory.

For China, it would also enable it to secure its oil supplies. Obviously, the trade would not be made in U.S. dollar. The yuan would be used, or even better, the famous e-RMB on which China has high hopes.

Russia, Iran’s historical partner, will join forces with these two countries to form a three-way alliance that would totally change the balance of power in the Middle East.

Many voices in the U.S. are calling for a digital dollar to be created as soon as possible

This agreement is of great concern to the United States and is not expected to be signed before 2021.

Many voices in the United States are saying that the country is making a monumental mistake by letting China take the lead in the area of the Blockchain and in the strategic area of state-backed digital currencies.

While the Fed refuses to hear of a digital dollar at the moment, reports have been produced by the U.S. Senate to study this hypothesis.

A digital dollar will emerge sooner or later. It is inevitable, because the digitalization of the world requires it.

Digital currencies are becoming a topic of interest for the GAFA

Even at the corporate level, the subject of digital currencies is becoming a crucial issue for the future. Facebook has understood this, and it is no coincidence that the company founded by Mark Zuckerberg has decided to embark on the adventure with the Libra project.

Facebook hoped to launch its private digital currency in 2020. However, the G7 member countries did everything possible to limit the scope of this project. Indeed, monetary creation must remain the prerogative of the States from their point of view.

Seeing Facebook impose its Libra was all the more worrying as the social network has more than 2 billion users all around the world.

Faced with pressure from the U.S. authorities, Facebook had to reduce the scope of its project while questions about user privacy were raised. Given Facebook’s track record in this area, it was impossible to trust Mark Zuckerberg on the subject.

From now on, Libra looks more like a payment system similar to PayPal that would work on all applications belonging to Facebook.

All these digital currencies are a major risk to your privacy

The issue of privacy is a crucial one. More and more people are realizing that this right they had taken for granted is not in reality. Like any right, you have to fight to keep it.

With these digital currencies, what you own can be censored even more easily than it is now. This is something extremely dangerous for all the inhabitants of the Earth, and many are beginning to open their eyes to this ugly truth.

This awareness is now found at all levels and is linked to the decentralization movement that is in full swing.

I hear some people say that these state or private digital currencies will be a threat to Bitcoin in the future. In a world where everything will be digital, Bitcoin could be harmed by these initiatives.

In fact, I think the opposite is true. Bitcoin will benefit from all these initiatives to see its adoption increase even more in the future.

Bitcoin will always have two essential advantages in the future

If the world of the future is completely digital, Bitcoin will always have two competitive advantages. Bitcoin will remain a separate species in any case for two main reasons:

- Its monetary policy

- Its decentralization

The e-RMB or the digital dollar will not change the monetary policy applied by all central banks around the world: printing more and more money out of thin air.

In fact, central banks such as the Fed are already printing money digitally at the moment. A digital dollar will therefore change nothing to their madness, which only devalues the value of the U.S. dollar even more.

In contrast, Bitcoin’s monetary policy will remain unchanged. This is an essential guarantee that Bitcoin offers you.

You know the maximum amount of Bitcoin that can be mined: 21 million. That amount will never change. Better yet, the issuance of new Bitcoins is automatic and predictable. It also reduces every 4 years or so, every 210,000 blocks actually mined, to ensure that inflation in the supply of new Bitcoins reaches zero by 2140.

Bitcoin highlights the virtues of quantitative hardening.

Bitcoin is the best store of value available to the greatest number

While fiat currencies continue to devalue in value over time as a result of the infinite increase in the supply of Bitcoins in circulation, Bitcoins already in circulation continue to increase in value as they become increasingly scarce over time.

Bitcoin is an incredible store of value accessible to the greatest number of people.

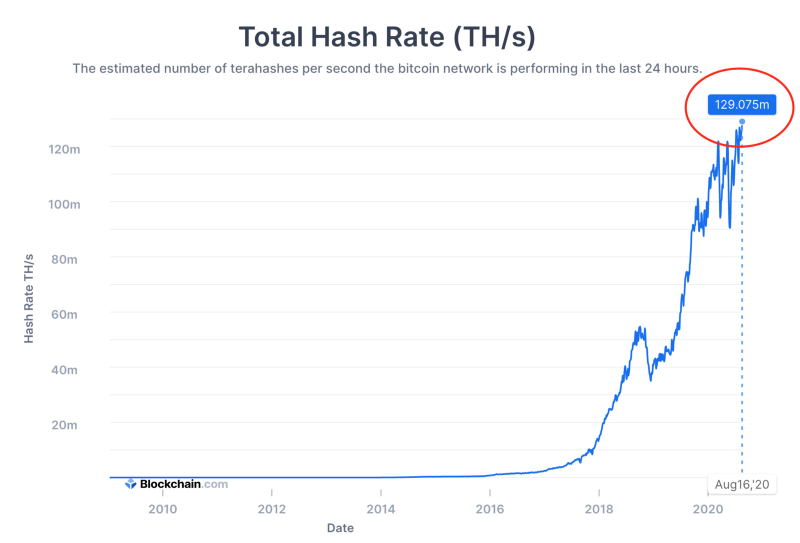

This first essential advantage of Bitcoin is complemented by the decentralization of its network. Bitcoin is the most secure decentralized network in the world.

Bitcoin has no leader and belongs to all its users.

Anyone can become a node in the Bitcoin network. The Bitcoin Blockchain is permissionless. It is transparent which means that anyone can verify everything that happens on the Bitcoin network at any time.

The Bitcoin motto is not usurped:

Don’t trust, Verify.

Bitcoin is a trustless system that creates trust between participants in its network. The secret lies in the fact that everyone is able to form their own opinion of the truth with Bitcoin.

The consensus reached among network participants only makes Bitcoin stronger every day.

On the Bitcoin network, no one can confiscate what you own. No one can stop you from making the transactions you want to make. Bitcoin gives you total freedom as long as you are in possession of the private keys associated with your Bitcoins.

Conclusion

The freedom that Bitcoin brings to its users allows you to reclaim a power that people should never have lost.

While the world of the future will be digital at all levels, Bitcoin will remain a separate species because of the features I have just described in this article. Its unparalleled monetary policy and total decentralization are incredible strengths that more and more people will be looking for in the years to come.

Bitcoin is here to stay, and the future belongs to it. You can be convinced of that.

1 Response

[…] more than 100 million users since 2009. Bitcoin is the people’s currency backed by the people. In a future world where everything will become digital, Bitcoin will be an essential weapon to protect you from the surveillance society that governments […]