Don’t Follow Blindly the Masses, Educate Yourself, Then Buy Bitcoin

Educate yourself because no one will take care of you for you.

The coronavirus pandemic was the trigger for the economic crisis that had been expected for years. This crisis was expected because the previous one, in 2008, had never really been resolved.

The Fed and other central banks had simply pushed the problem into the future by printing hundreds of billions of dollars. As always when you don’t really solve the root causes of a problem, it will resurface at some point.

The economic crisis that starts in 2020 has its roots in the crisis of 2008 that has not been solved.

The problem is that by putting off solving the ills of the economy each time until later, their magnitude is immensely greater the next time.

Liquidity injections amount to trillions of dollars

For example, a few hundred billion dollars were enough to stem the effects of the economic crisis in 2008. By 2020, we are already at more than $10 trillion injected into the system by the various central banks of the world’s major economic powers.

The Fed is of course leading the way with its unlimited quantitative easing program decided on March 23, 2020.

Nevertheless, other central banks are moving towards the same solution, as shown by the decision taken on April 27, 2020 by the Bank of Japan to also carry out a program of unlimited quantitative easing.

There is little doubt that other central banks will follow.

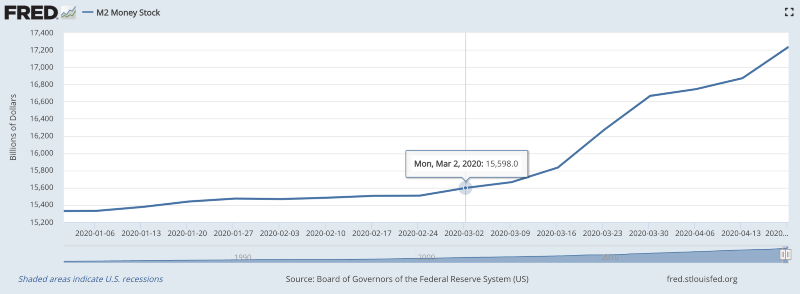

These massive injections of liquidity have resulted in the U.S. dollar’s money supply reaching record highs in recent weeks.

Quite simply, since the start of the coronavirus crisis, the Fed’s M2 Money Stock has jumped by more than $2 trillion:

The latest figures updated by the Fed stop at April 20, 2020 and give a M2 Money Stock at $17.234 trillion. At the current rate of increase, we should already be close to the $18 trillion mark.

Such growth in the M2 Money Stock in such a short period of time is unprecedented.

By continuing at this pace of liquidity injection, the Fed could raise the M2 Money Stock to $30 trillion by the end of the year.

Financial markets are artificially inflated

All these liquidity injections have allowed financial markets such as Wall Street to see their levels artificially inflated. After hitting a low of 18,591 points on March 23, 2020, the Dow Jones has now risen to 23,723 points, an increase of +28%:

The S&P 500 has been tracking roughly the same recovery since its low point on March 23, 2020.

The problem is that this recovery ofWall Street is very weak given everything the Fed has injected into the system.

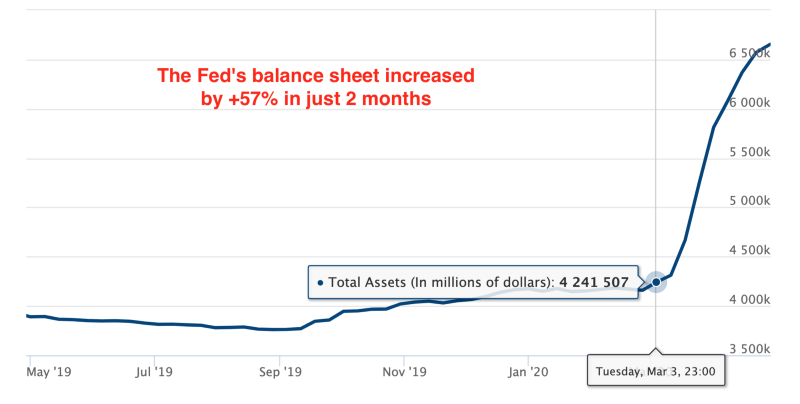

Moreover, it is totally artificial as shown by the historical increase in the Fed’s balance sheet which has just exceeded 6.5 trillion dollars:

Despite all the money injected by the Fed to support the system, the U.S. economy is in dire straits. A total mismatch has been created between the real economy and the situation on the financial markets.

The situation of the real economy is increasingly worrying

In the last six weeks, the number of job seekers in the United States has increased by 30.3 million. The unemployment rate in the United States has risen from 3.5% at the end of February 2020 to more than 20%.

The stimulus check of $1,200 sent to every eligible American under the $2T stimulus package from the U.S. government and Congress has not made much difference to the plight of millions of people.

US GDP figures for the first quarter of 2020 have just come in. They show a historic drop of 4.8%.

The most worrying thing is that its fall should be even greater in the second quarter of 2020. This is almost certain because American consumption is also in free fall because of the lockdown decided to fight against the spread of the coronavirus.

Requests for bailouts from large American companies are constantly coming from the federal government. The example of American Airlines is striking. The airline announced that it has lost more than 2.2 billion dollars in the first quarter of 2020.

Currently, American Airlines is losing $70 million a day.

The American government will not let American Airlines down. A big check will be given to avoid a total bankruptcy.

Recent government announcements indicate that hundreds of billions of dollars will be used to bailout such companies.

The American Airlines situation is typical of what we are seeing right now.

Over the past few years, large companies have preferred to conduct massive share buybacks in order to artificially inflate their share price on the stock market rather than build up a larger cash position in the event of a major blow like the one we are currently experiencing.

The poorest will have to foot the bill for this economic crisis

The result has been disastrous, but the main problem is that it is not the culprits who will foot the bill.

One way of looking at the current situation is that these companies and their shareholders should be left out in their current situation. They have taken reckless risks and it would be normal for them to foot the bill today.

Unfortunately, with the current monetary and financial system, that is not the case. At the end of the day, it is the citizens who will foot the bill.

The bill will be paid in two stages. First, with the unprecedented monetary devaluation that will result from massive injections of liquidity by central banks. As the theories behind the Cantillon Effect explain very well, the poorest people will be the most affected.

Conversely, the richest people will become even richer with all the measures currently being taken.

Secondly, the stimulus plans decided by the American government and the American Congress are pushing up the American debt, which already exceeds $24 trillion. Obviously, future generations will have to carry the burden of this pharaonic public debt on their shoulders.

Don’t follow blindly what those at the head of the fiat system tell you

Faced with this exceptional situation, you may be part of this majority of people who decide to follow the masses. These people continue to believe blindly in the American dollar in spite of everything.

Some are really blinded by the fiat system. They see no reason to change things, because they finally consider themselves rich enough. They don’t realize that sooner or later they will be next on the list to have to endure future currency devaluations in future economic crises.

Others are beginning to doubt the fiat system. They are disappointed, but think they have no alternative.

Whatever category you belong to in the current monetary and financial system, you must be aware of one essential thing:

No one else that you will be able to take care of your financial situation.

You should not expect miracles from a system that has been increasing disparities since its de facto creation by Richard Nixon in August 1971. This system has shown repeatedly for almost 50 years that it is failing.

What is even more serious is that the people at the head of this system have no desire to question it in order to find a more protective alternative for citizens.

An alternative solution emerged from the 2008 crisis

After the crisis of 2008, the mysterious Satoshi Nakamoto decided to propose an alternative solution. He offered this alternative solution to the whole world as a gift. This solution has been adopted over time by an increasing number of people.

Today, Bitcoin is emerging as the best option for opting out of the current monetary and financial system.

Bitcoin gives power back to its users. It is a true democracy that has been growing for eleven years thanks to the will and convictions of all Bitcoiners.

Rather than blindly following the masses, you must educate yourself. This means going beyond what the people at the top of the system want you to know. So you have to be interested in money, and more importantly, you have to understand how the current system works.

Next, you need to read Satoshi Nakamoto’s Bitcoin white paper to put the simplicity of how Bitcoin works into perspective with the complexity of the fiat system.

Bitcoin encourages you to question everything in order to get an idea of things for yourself rather than blindly believing what the masses think. This is reflected in one of its famous slogans:

“Don’t trust, Verify”.

Bitcoin gives you the power to choose

By choosing to understand for yourself instead of believing what the powerful of the fiat system want you to know, you will be taking the first step on a long journey that will lead to educating yourself for freeing yourself from what you thought was immutable until then.

This first step is the most difficult, as Lao Tzu said so well:

“The journey of a thousand miles begins with one step.”

Lao Tzu

Once you have taken this first step, you will continue to learn Bitcoin. Step by step, you will discover how easy it is to make cross-border payments around the world at low cost. Then you will discover its quantitative hardening monetary policy that really protects what you own.

Even better, you will have the opportunity to discover that Bitcoin is much more than just a financial investment. Bitcoin is a multi-faceted revolution: technological, industrial, ideological, and social.

Bitcoin plays a fundamental role in the protection of human rights.

It allows you to make the choice to live your life on your own terms. By choosing to opt out when you buy Bitcoin, you will be able to prepare a better future for your children as well.

Sooner or later, you may have the chance to become a Bitcoiner who in turn will seek to share with others what he or she has learned, and continues to learn with the Bitcoin revolution. This is one of the fundamental reasons why I write stories about Bitcoin.

My goal is to help as many people as possible to educate themselves properly in order to make the right decisions for their future.

Making the right decisions requires not blindly following others, but having the ability to think for yourself.

So I hope that after reading this story, you will have the will to continue to go further in Bitcoin to really educate yourself. If you make that choice, I am convinced that you will end up buying Bitcoin like me and so many others have done before.

Even if you don’t make that choice, you will benefit from being truly educated, because you will be able to make the best decisions to protect yourself in the current economic crisis.

It’s up to you now.