Bitcoin — The Day After Tomorrow

A look back at the purging of the cryptocurrency market on March 12, 2020.

Today is March 13, 2020. Without getting too far ahead of myself, I can already tell you that March 12, 2020 will go down in the annals of Bitcoin, and more generally in those of the cryptocurrency industry.

The week had already started badly for Bitcoin. During the weekend of March 8 and 9, 2020, Bitcoin price went from $9.1K to $7.7K. In addition to the uncertainty caused by the spread of the coronavirus around the world, an oil crisis started at the initiative of Saudi Arabia.

During the first days of this week, the financial markets also continued to lose a lot of value. Most stock exchanges lost more than 10%. These losses came on top of what they had already lost since the beginning of February 2020.

On March 12, 2020, the measures taken by the President of the United States to combat the spread of the coronavirus on American soil created a real panic that impacted deeply the cryptocurrency market too.

It must be said that the measures taken by Donald Trump are almost unprecedented, culminating in the almost total suspension of all flights from Europe to the United States.

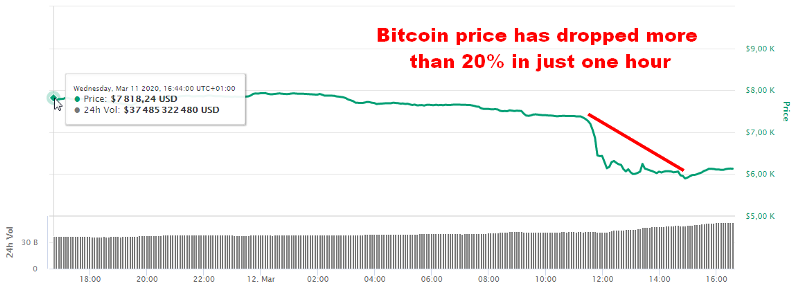

At around 11:00 UTC, Bitcoin price was still $7,300. And then, all of a sudden, within the space of an hour Bitcoin price dropped more than $1,500!

On some trading platforms, such as Coinbase, Bitcoin price even dropped to around $5,400.

That’s a drop of more than 25% in just one hour. Taking into account the price of Bitcoin on other trading platforms, the drop was between 20% and 25%:

In the space of an hour, several hundred million dollars were thus liquidated on the trading platforms.

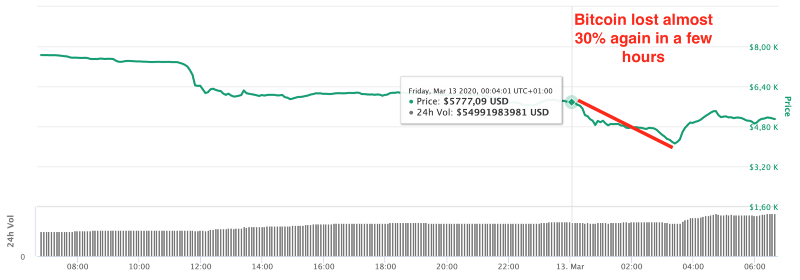

On the night of March 12–13, 2020, while we were in the late afternoon of March 12 in the United States, Bitcoin saw red again. While its price had stabilized at around $5,800, a sharp drop took place again causing it to drop just above $4K:

On some exchanges, Bitcoin price has even fallen below the symbolic $4K mark.

At the time of writing, Bitcoin price has stabilized at around $5,000 for the time being. Nevertheless, the next few days are going to be extremely chaotic.

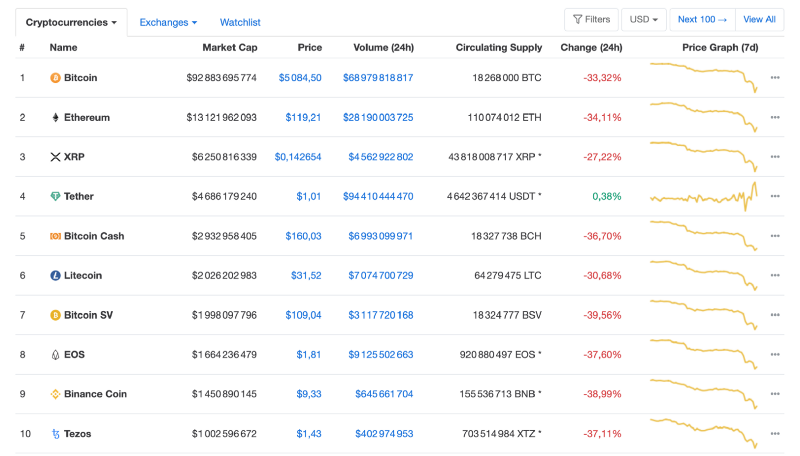

Looking at the rest of the cryptocurrency market, we can see that no cryptocurrency was spared during this purge. Bitcoin has lost 33% of its value in 24 hours, and for some Altcoins, it’s even worse:

In a matter of hours, the market capitalization of the cryptocurrency industry lost over $60 billion. Losses were even more than $80 billion at the worst of the day.

On this day, the financial markets around the world have obviously not been spared as you can imagine. Losses typically range from 8 to 15%.

Even gold, which has been a recognized safe haven for centuries, lost 4% on this black day.

All of this reflects the fear and panic of investors who are primarily looking for maximum liquidity. So we are indeed witnessing a real liquidity crisis that is still in its infancy.

This is the situation we are in as we stand on the day after this terrible purge on the cryptocurrency market, and on the financial markets as a whole.

And Now What?

The big question now is what the future holds. As I always tell you, no one can predict the future. Nevertheless, I will give you my feeling.

When a crisis of this magnitude sets in, the vast majority of people panic. Fear leads these people to sell what they own at any price on liquid markets in order to recover as much cash as possible.

As a result, these people are even willing to sell their assets well below their true value. The important thing is to get cash at all costs.

For this reason, the financial markets are plunging, and so is gold, while the precious metal is unanimously recognized as a reserve value in times of crisis.

All this does not call into question the status of gold. On the contrary, it confirms that no liquid market will be spared in the coming days and weeks.

Many argue that the sharp drop in Bitcoin price that we just witnessed yesterday calls into question its status as a safe haven in times of crisis. Personally, I don’t think so.

Like gold, the Bitcoin market is liquid. In fact, investors have not been spared when it comes to withdrawing the maximum amount of liquidity in anticipation of the economic crisis that we may see.

Bitcoin price has hit its low around $4K yesterday.

It can still drop to around $3.5K or $3K, but I don’t think it will go much lower. The people most likely to surrender have almost all left the market by now. The last ones to go out today.

The people who remain in the market are those who fundamentally believe in Bitcoin and its revolution. These people are Bitcoiners who will support Bitcoin no matter what. Their strategy is simple:

HODL Bitcoin whatever it takes.

This is also my strategy, which is why I took advantage yesterday of the drop in Bitcoin price to trade fiat currency for additional Bitcoins.

It’s a personal choice that only involves me, but is shared by thousands of other Bitcoiners.

In the coming days and weeks, the Federal Reserve will probably have to lower interest rates again. It has already done so on March 3, 2020 by unanimously deciding on a historic 50 basis point cut.

But this will probably not be enough to get the United States out of the major economic crisis that is emerging.

Donald Trump calls for the Federal Reserve to follow the path of the European Central Bank by lowering interest rates to zero, or even to negative rates.

The logical consequence of this decision will be the application of a policy of quantitative easing which will make it possible to inject liquidity to support the system.

The Federal Reserve has just urgently decided to inject 1.5 trillion dollars of liquidity to support the American economy. Yes, you read right: $1,500,000,000,000!

Such a decision will inevitably increase the money supply in circulation, which will further devalue the value of what you own in U.S. dollar.

Politicians and central bankers know that what they do devalues what a majority of people own, but they will continue to apply this policy, because it is the solution they have been applying for decades.

Europe, which already has negative interest rates at -0.50%, will probably also apply a policy of quantitative easing in order to prevent the current system from collapsing completely.

The management of the economic crisis through this monetary policy of continuous inflation of the money supply in circulation will occur at the very moment when the third Bitcoin Halving is approaching.

We are now less than 60 days away from the third Bitcoin Halving.

Around May 11, 2020, the daily creation of new Bitcoins will be halved no matter what happens. The annual inflation of the available Bitcoin supply will drop below 2% for the first time. It will be 1.8% until the next Halving which will take place 210,000 blocks later. Probably in 2024.

Bitcoin’s monetary creation policy is programmatic and predictable.

No human can make the arbitrary decision to change it. I sincerely believe that this model that makes Bitcoin the scarcest thing humans have ever created will allow Bitcoin price to take off once the crisis really takes hold.

Bitcoin is falling right now, but that’s mainly because everyone is looking for liquidity.

Gold had fallen by more than 20% in 2008 when the banking and financial crisis broke out. This did not prevent it from playing its role as a safe haven once the crisis really took hold. Its price then rose sharply.

For Bitcoin, I see a similar scenario in the coming months and years. The difference is that the supply of Bitcoin will continue to decrease at the same time as the demand for Bitcoin is increasing.

For my part, I see no reason to panic as a result of this purge in the cryptocurrency market. The fundamentals of Bitcoin are the same, and events are even pointing in the direction of the sharp increase that all Bitcoiners are predicting for Bitcoin price in the 18 months following its May 2020 Halving.

Finally, never forget this quote from Warren Buffett:

“Be Fearful When Others Are Greedy and Greedy When Others Are Fearful”

— Warren Buffett

Today, when fear is extreme in the Bitcoin market, I believe the time has come for you to be greedy.

1 Response

[…] Bitcoin — The Day After Tomorrow […]