Bitcoin Is a Better Store of Value for the Masses Than Gold

Bitcoin is objectively superior to gold for the masses.

Block after block, Bitcoin continues its inexorable forward march. Bitcoin’s Black Thursday in March 2020 raised doubts about Bitcoin’s status as a store of value among those who do not fundamentally believe in its revolution.

Bitcoiners took advantage of this incredible opportunity to accumulate more Bitcoin at an extraordinarily low price. What happened next has once again proven those who believe in Bitcoin are right.

In a strong upward movement, Bitcoin took advantage of the beginning of the week to completely erase its fall from Black Thursday and finally continue to progress. At the time of this writing, Bitcoin price has even surpassed $9,000 and is now around $9,200.

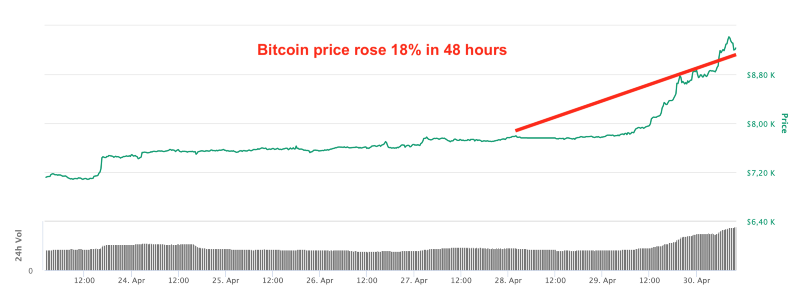

In 48 hours, Bitcoin price has gone from $7,800 to $9,200, an increase of 18%:

Since Black Thursday when its price dropped to $3,800, Bitcoin price has risen by more than 142%.

While Bitcoin’s third Halving will take place in just 12 days from now, Bitcoin is already showing the best performance since the beginning of the year compared to other major assets:

- Bitcoin : +28%

- Gold: +13%

- Dow Jones: -15%

- S&P 500: -10%

- Oil: -75%

On discovering these figures, the first thing that becomes clear is that the economic crisis that is starting to take hold is going to favor the growth of assets that are safe haven in times of crisis.

It is therefore quite normal that stores of value such as gold and Bitcoin have been growing strongly since the beginning of the year.

Taking the analysis a step further, I will show you why Bitcoin is even a better store of value for the masses than gold.

Bitcoin is more easily accessible than gold

Gold has been a recognized store of value for centuries. The precious metal is something tangible that was the basis of the monetary system in the past.

Gold lost its standard status when Richard Nixon ended the convertibility of the U.S. dollar into gold in August 1971.

Nevertheless, gold is still something that Baby Boomers love to own. Gold has the ability to reassure, as it increases in value when a recession sets in, as it does now.

Buying gold, however, is still something that is difficult for the people who need it most: the poorest people.

Indeed, the richest people already have diversified assets, often including real estate, stocks and bonds. The poor, on the other hand, often have only cash in their possession.

In times of currency devaluation, such as the one we will experience in the coming weeks and months, those who have most cash will be the most affected. The purchasing power associated with this cash will fall drastically.

Unfortunately, they will not be able to buy gold. The price of gold is too high for them. In addition, the conditions of access to gold are too complicated.

On the other hand, Bitcoin can be bought very easily. Internet access and a smartphone are sufficient to buy Bitcoin.

Even better, Bitcoin is divisible up to eight decimal places. A poor person can therefore make the choice to buy only a very small amount of Bitcoin to start with.

Storing Bitcoin is extremely simple and secure. All you need to do is remember a 24-word sentence in your head. So no one can steal your Bitcoin. For gold, it’s clearly not the same thing.

Finally, Bitcoin is more recognizable than gold. Not everyone can verify that a metal is gold.

Bitcoin cannot be confiscated

Another major problem with gold is that it can easily be confiscated. If you own your wealth in gold, you will have a hard time transporting it to the other side of the world.

At customs, the authorities will ask you a lot of questions, and you are likely to have a lot of trouble with your gold.

If all goes well, carrying gold with you on a journey will not be a reassuring experience. Imagine that someone steals your bag where your gold is. You would lose all your wealth.

With Bitcoin, this is clearly not a problem. The portability of Bitcoin is an incredible strength that no other conventional asset can match.

Gold suffers another major issue. If you want to sell a large amount of gold at any given time, you’re going to have to go through specialized platforms that will ask you a lot of questions. Again, you risk having your transaction censored, or even worse, your gold confiscated.

Bitcoin is resistant to censorship and “unconfiscatable”.

You can make any kind of transaction with your Bitcoins. You can exchange all your Bitcoins for cash 24 hours a day, 7 days a week. Bitcoin works all the time.

The liquidity crisis we experienced in March 2020 has reinforced Bitcoin’s status as the world’s only true free market. Its superiority on Wall Street and other financial markets was highlighted in the midst of the storm.

Bitcoin is scarcer than gold

You probably know the key figures of Bitcoin as well as I do. The maximum amount of Bitcoin that can be put into circulation is 21 million. At the time of writing, 18,353,200 BTC have already been put into circulation.

Only 2,646,800 BTC remain to be mined.

By the time you read this story, that number will be even lower. What is most interesting is that the daily supply of new Bitcoins is shrinking over time.

With every Bitcoin Halving, or every 210,000 blocks of transactions mined, the reward for miners is halved. As of May 12, 2020, this reward will decrease from 12.5 BTC to 6.25 BTC. Thus, the daily supply of new Bitcoins will decrease from 1800 BTC to 900 BTC.

As time goes by, Bitcoin is becoming more and more scarce which increases the value of each of its units. This is known as a quantitative hardening monetary policy.

No one can say exactly how much gold can be mined on Earth. Estimates say 190,040 tonnes, but there is no certainty.

Each year, mining operations currently produce between 2,500 and 3,000 tonnes of gold.

It should be noted that 40% of the gold extracted each year comes from the Witwatersrand Basin mine in South Africa. At its peak in 1970, the mine accounted for 80% of world gold production.

The big question about gold is: how much gold is left in the world?

Unfortunately, with gold, things are not as clear-cut as they are with Bitcoin. It is very difficult to determine how much gold remains to be mined. We know that gold represents up about four parts per billion of the earth’s crust.

What we don’t know is the exact amount of gold that remains to be mined.

The World Gold Council estimates that there are currently 54,000 tonnes of underground gold reserves ready to be mined. These reserves represent less than 30% of what has been mined to date.

Gold offers you no certainty about its scarcity, especially since new deposits could be discovered. Only one thing is certain: Bitcoin is much more scarcer than gold.

Two figures to help you understand how scarce Bitcoin is:

- 21 million Bitcoins for 7.7 billion people in 2020.

- 21 million Bitcoins for a projection of 10.9 billion inhabitants in 2020.

The number of inhabitants on Earth is expected to increase sharply in the future, but Bitcoin will remain as scarce as ever with a limited quantity of 21 million.

Bitcoin’s higher volatility is an advantageous feature

Opponents of Bitcoin often use the argument that it is too volatile compared to gold. Bitcoin’s volatility would prevent it from being as valuable a store of value as gold from listening to these non-believers.

The essential thing to understand is that Bitcoin’s volatility is not a bug, but a feature.

Bitcoin can be extremely volatile. This has been proven lately in both directions:

- First of all, on Bitcoin’s Black Thursday in March 2020, when Bitcoin lost around 50% of its value in a few hours. At almost the same time, the fall in gold was only 12%.

- Then, from April 28 to April 30, 2020, when Bitcoin price rose by almost 20% in 48 hours. Gold remained broadly stable over the same period.

So there is no doubt that Bitcoin is much more volatile than gold. This volatility can be your best ally, or your greatest enemy.

If you know how to use Bitcoin’s volatility to your advantage, it will become your best ally.

By buying Bitcoin, and being convinced of its importance for the future, you will be able to become a Bitcoin HODLER. By adopting this strategy, you will be able to keep your Bitcoins when the price drops sharply.

Better yet, you will take advantage of the sharp drops in Bitcoin price that may occur a few times to accumulate even more Bitcoins.

When Bitcoin rises in price, you will be amply rewarded for your absolute belief in its revolution. On May 12, 2020, Bitcoin will experience a historic supply shock that will bring its inflation below 2% for the first time in its history.

Historically, a Bitcoin Halving is followed by an 18–24 month period during which Bitcoin price enters a very strong bull market.

This third Bitcoin Halving should be no exception to what will become the rule. The U.S. dollar injections by the Fed coming at the same time will only strengthen the demand for Bitcoin as millions of people will want to protect themselves from the resulting currency devaluation.

In this context of economic crisis with a strong recession, the volatility of Bitcoin will allow for a very strong increase in its price. The $100K remains more than ever in the line of sight for the end of 2021.

Conclusion

Gold has been a recognized store of value for decades. This seniority has so far given the precious metal a significant psychological advantage over Bitcoin in the mind of lot of people.

As time passes and Bitcoin proves its strength, the gold seniority’s advantage gradually fades away.

Bitcoin has many advantages over gold that objectively make it a better store of value for the masses. The fact that thousands of Americans are choosing to buy Bitcoin with their $1,200 stimulus check instead of gold clearly shows that Bitcoin is considered more affordable.

More accessible, but also more promising, as Bitcoin’s volatility suggests that its price has a much higher upside potential in the coming months and years than gold.

1 Response

[…] than ever, Bitcoin validated its status as the best possible store of value for the greatest number of people during this year. The increase in the number of Bitcoin HODLers reflects this. And this is just the […]