Stop Using Weak Money Like U.S. Dollar for Pricing Bitcoin, Use Gold Instead for More Accuracy

Don’t compare apples to oranges.

You have probably heard at least once the expression that it is futile to compare apples to oranges. This expression has certain variations in the rest of the world. In South America, it is often said that you should never compare potatoes and sweet potatoes.

In Europe, this expression applies to apples and pears.

In any case, the deeper meaning of the expression is always the same. In life, there is no point in comparing radically different things.

Applying this to money and Bitcoin, more and more voices are being raised in the Bitcoin world to say that it is counterproductive to price Bitcoin in the U.S. dollar.

Pricing Bitcoin in weak money such as the U.S. dollar is irrelevant

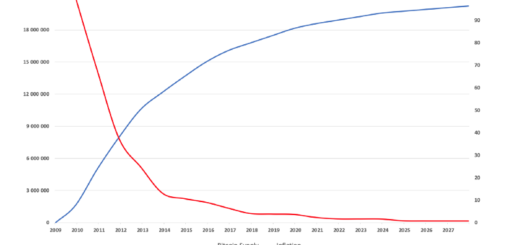

Indeed, the U.S. dollar is a weak currency that has been continuously devalued for almost 50 years. Thus, the purchasing power of $1,000 in August 1971 lost more than 85% of its value in 2020 to not even represent a purchasing power of $150.

Pricing Bitcoin in the U.S. dollar will, therefore, tend to boost the Bitcoin price more rapidly due to the effects of the monetary inflation we have been experiencing for the past 50 years, which accelerates dramatically in 2020.

As a reminder, Bitcoin is the hardest money in the world. Comparing the U.S. dollar and Bitcoin is like comparing apples to oranges. A fairer comparison for Bitcoin can be made with gold.

Gold has been a recognized store of value for centuries now.

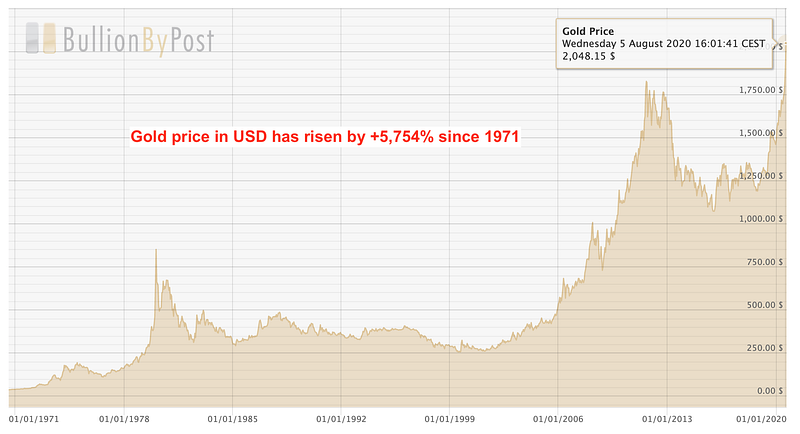

The price of an ounce of gold has exploded against the U.S. dollar in the last 50 years

Richard Nixon de facto established the current monetary and financial system in August 1971. At that time, the price of an ounce of gold was $35. In a little less than 50 years, the gold price has therefore risen by +5,754%:

On August 5, 2020, the price of an ounce of gold surpassed $2,000 for the first time in its history.

This historic record per ounce of gold is credited to the growing weakness of the U.S. dollar. The great monetary inflation continues to devalue the world’s reserve currency.

The almost infinite increase in U.S. public debt weakens the entire current monetary and financial system. Apart from the Fed, not many people are interested in the 10-year U.S. T-notes anymore. Interest rates are far too low, even negative when adjusted for the effects of inflation.

Worse still, more and more people have doubts about the United States and the U.S. dollar.

All stores of value are up in the face of the weak U.S. dollar

Under these conditions, the price of gold is only increasing. The price of silver has also jumped in 2020. Quite naturally, the Bitcoin price has followed the same path, as Bitcoin has seen its price increase by +65% since the beginning of the year.

The economic crisis of 2020 has at least had the merit of proving to non-believers that Bitcoin is here to stay and that it is above all a formidable store of value.

Gold exists in limited quantities on Earth. Unlike Bitcoin, whose maximum quantity is known to be 21 million units, it is difficult to evaluate it for gold. It is also possible to find new gold deposits, which makes the precious metal less scarce than Bitcoin.

Nevertheless, like Bitcoin, extracting gold has a real cost. It is not possible to create gold out of thin air as is done by the Fed for the U.S. dollar.

The price of an ounce of gold is boosted by U.S. dollar inflation just as the price of Bitcoin is.

Comparing the Bitcoin price to the price of an ounce of gold is much more relevant

As such, pricing Bitcoin in gold is therefore much more relevant, as it allows for a comparison of the two best available stores of value by removing the effects of inflation. Of course, Bitcoin is a better store of value than gold for various reasons.

Bitcoin is mostly accessible to the masses, whereas gold is reserved for the elite.

This is where the real comparison for the upcoming years comes into play, as the two stores of value have many features in common:

- Cannot be hyperinflated.

- Deflationary.

- Decentralized.

- Hard to confiscate, although only Bitcoin cannot be confiscated.

- A real cost to produce.

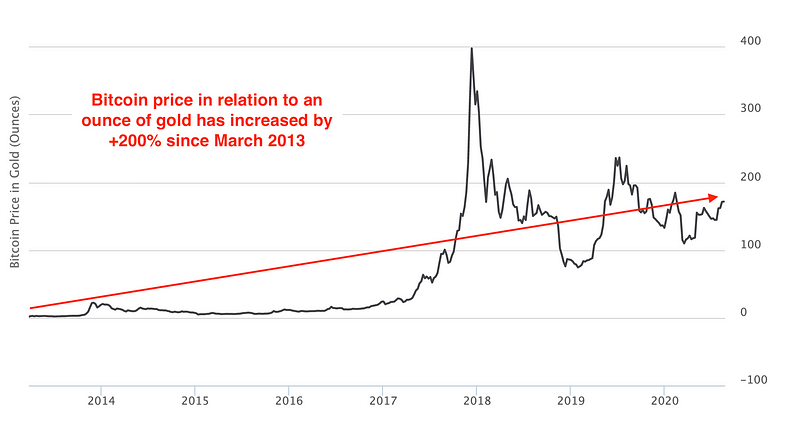

The Buy Bitcoin Worldwide website provides a weekly updated chart of the Bitcoin price compared to the price of an ounce of gold.

As of August 17, 2020, one Bitcoin was worth 5.974 ounces of gold:

As you can see on this chart, at the peak of the previous Bitcoin Bull Run in December 2017, one Bitcoin represented nearly 400 ounces of gold.

The increase in the price of an ounce of gold since December 2017 coupled with the decline in the Bitcoin price has reduced this ratio to just under 6 ounces of gold for a Bitcoin at this time.

After hitting an all-time high near $2,100, the price of an ounce of gold has fallen back slightly to around $1,940. Gold stays therefore currently in its highest price range.

Bitcoin is still far from its record price of $20K reached at the end of 2017.

Conclusion

When the next Bitcoin Bull Run has started, the Bitcoin price will soar. Seeing Bitcoin reaching $50K by the end of 2021 is my most conservative assumption. If I am optimistic, I would even expect a Bitcoin close to $100K.

At that time, the ratio of Bitcoin to an ounce of gold should be between 20 and 50. The next few months are going to be exciting for Bitcoin.

While we will probably continue to use U.S. dollar pricing for Bitcoin because it is more meaningful for most people, you should keep in mind that for more information on the real value of Bitcoin, using a pricing per ounce of gold is the way to go.

By comparing Bitcoin to gold, you will get rid of the bias of a weak U.S. dollar. You will be comparing two sound money, and it will be much more relevant.